How Can You Beat the S&P500 Stock Market?

We will explain the methodology used at Goldman Sachs Asset Management.

But first let's remember what is the SP500.

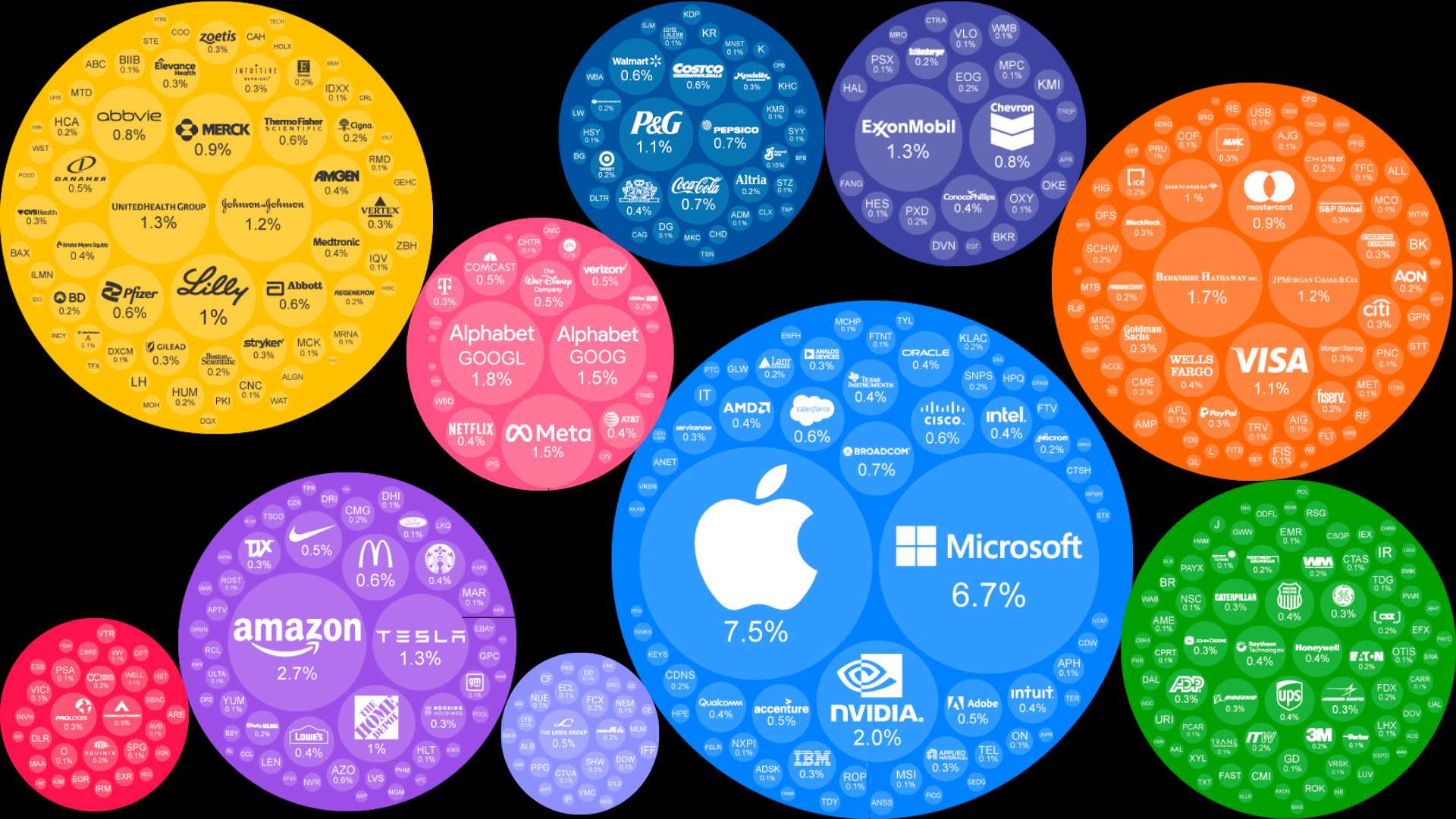

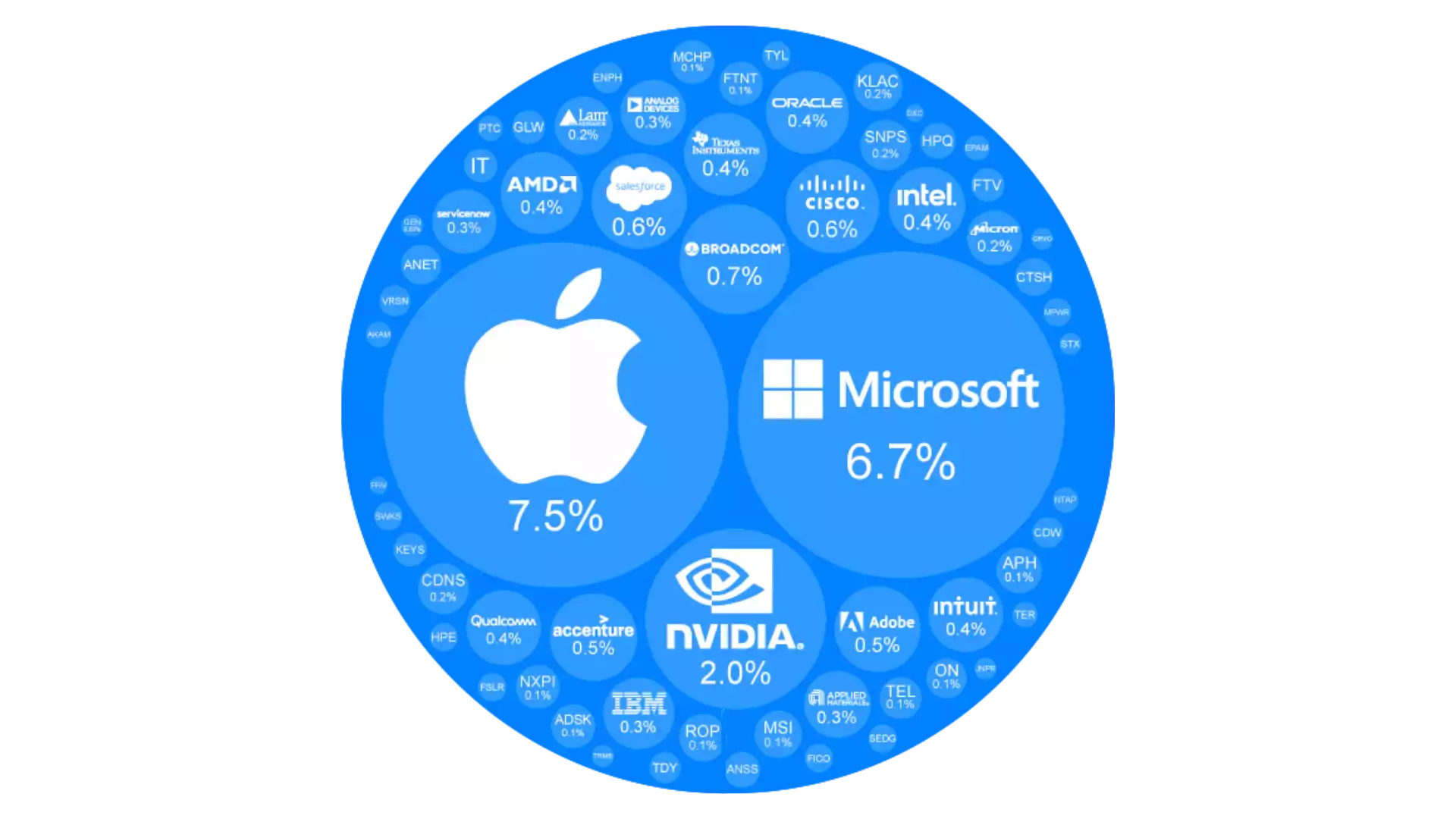

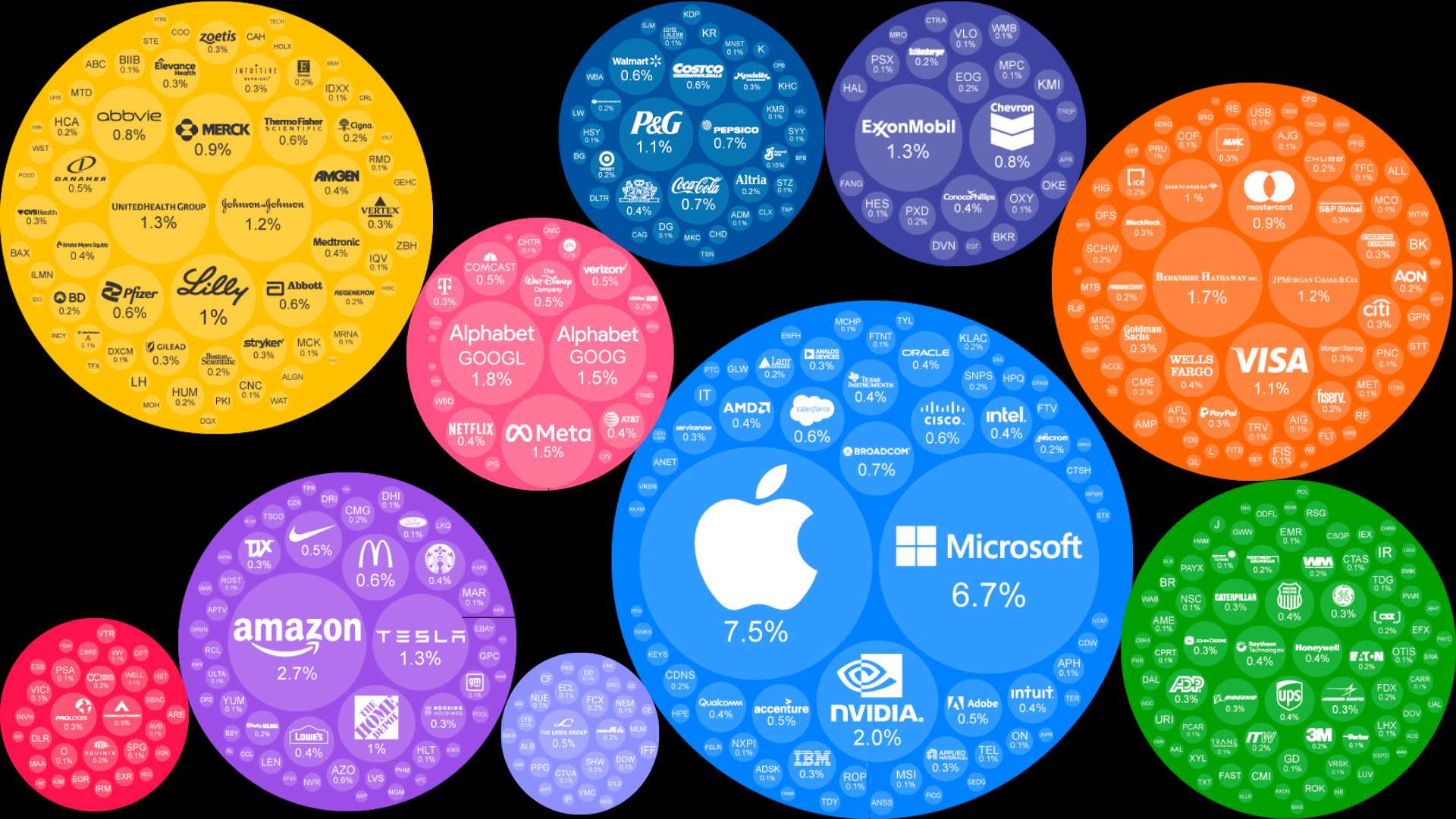

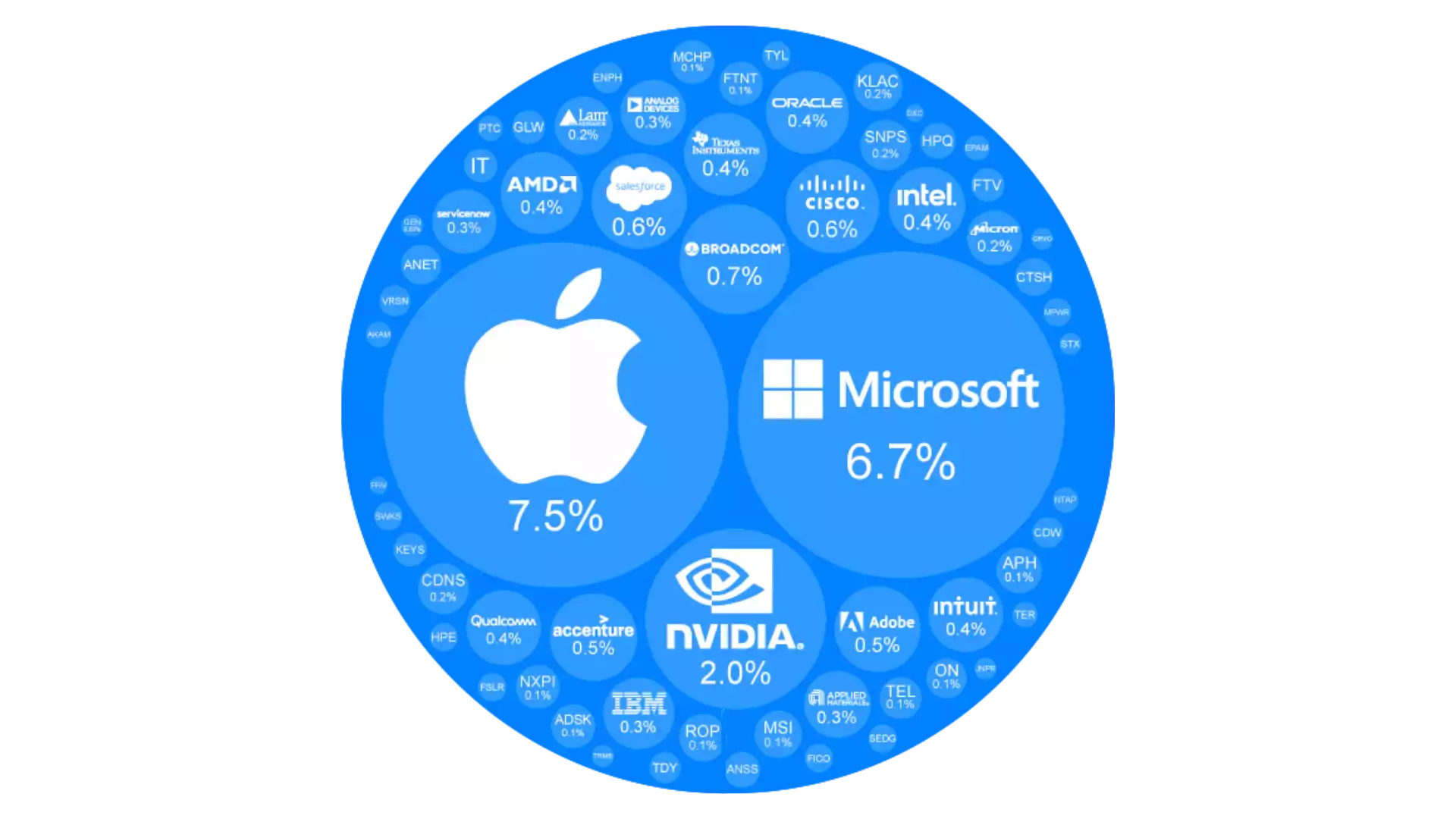

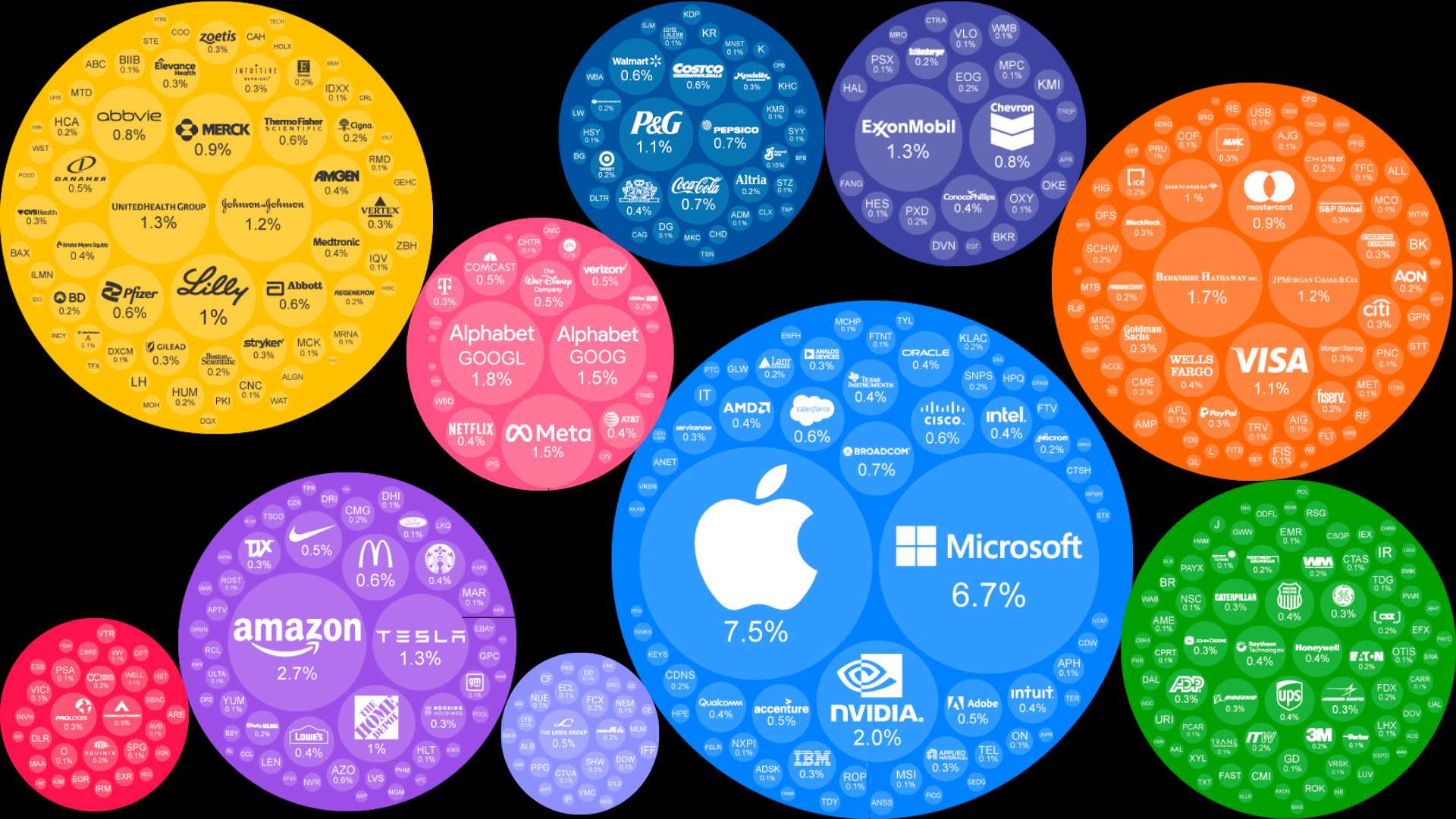

The S&P500 stock market is a big financial playground.

It is made up of different sectors, like technology and healthcare.

Imagine it as a team of 500 players.

Each player being a stock from various companies.

All these players work together.

And their price performance affects how well the entire team, or stock market, is doing.

So, when we talk about the S&P500 market, we're looking at how all these stocks are doing together.

It is well known that over the long run, only very few investors manage to outperform the S&P500.

We will teach you how to beat the S&P500 stock market.

You will know what stocks to buy and focus your trading on.

You could become the next Warren Buffett by understanding what drives your performance and how to make better investment decisions.

Welcome: Performance Attribution!

Performance Attribution

Our in-app performance attribution allows you to understand what are your skills.

What you are good at.

And what are the stocks you should invest in.

Attribution explains your performance over the S&P500 or any other market benchmark.

It tells you what are the best stocks and market segmentations for you to focus on in order to maximize your profits.

The better you are at making money with certains stocks, the more money and passive income you will generate with them.

Focus your time and energy on what you are good at.

1) Selection Skill

Are you great at buying technology stocks that outperform the sp500 technology sector?

If so, you have superior tech selection skills!

Are you good at selecting healthcare stocks that outperform the sp500 healthcare sector?

If so, you have superior healthcare selection skills.

And so on.

Selection skills tell you how good you are at selecting the stocks that will outperform its respective sector segment.

2) Allocation Skill

You could be doing great at forecasting what would happen to Technology stocks:

- increasing your positions (buying more tech stocks) when you expect the sector to be doing well,

- and decreasing them (selling them) when you expect it to perform poorly.

Are you great at allocating your investments across sectors?

Are you great at timing which stock market sector will go up?

Are you good at timing when you should buy vs sell?

If so, you have superior allocation skills.

Some of you are good at timing which overall sector to buy and when.

Others are good at picking which stocks to buy within a particular sector.

Use StocksToBuyNow app to receive insights on allocation timing!

3) Interaction Skill

For example, if:

- 1) you had superior selection skills (you are great at picking stocks in a specific market sector)

- 2) and overweighted that particular sector (you knew it would go up)

-> the interaction effect would be positive!

However, if:

- 1) you had superior selection,

- 2) but underweighted that stock market sector (you thought this it would go down)

-> the interaction effect would be negative.

In this case, you did not take advantage of the superior selection by allocating more assets to that sector.

If you want to beat the s&p500, you must understand your performance attribution skills

Understand how good you are at picking stocks in each market sector.

And analyze with StocksToBuyNow how good you are at forecasting which stock market sector will be going up.

Do you know your strengths? Do you know how to make money with stocks?

Don't worry, we are here to help you!

The Math behind

In StocksToBuyNow App, your AI Financial Advisor can segment your portfolio per sector.

There are 500 stocks, you can't just look at everything.

You will get overwhelmed.

Focus on what you are good at!

Understanding the math behind how we do it help you understand why it works.

It will develop trust in our tools and further improve your trading skills.

1) Selection Skill

The selection effect measures the investor's ability to select / pick the best stocks within a given sector.

We see whether you beat the market by comparing your picks to the SP500 market picks for the same sector.

A positive selection effect occurs for a particular market sector when your stock portfolio return is greater than the SP500 market return.

The Selection Effect for the Technology stocks is calculated using the below metrics and formula:

-

- Technology stocks weight in the S&P500

-

- Technology stocks return of the S&P500

-

- Technology stocks return of our Portfolio

2) Allocation Skill

The allocation effect measures the investor's ability to effectively allocate their portfolio's assets to winning sectors.

Positive allocation occurs when you overweighted (buy more of) a sector that performs better than the S&P500.

It also happens when you underweighted (buy less of) a sector that doesn't perform as well as the S&P500.

The Allocation Effect for the Technology stock is calculated using the below formula:

-

- Technology stocks weight in our Portfolio

-

- Technology stocks weight in the S&P500

-

- Technology stocks return of the S&P500

-

- Total price return of the S&P500

3) Interaction Skill

If you are good at selecting stocks for a particular sector, you should overallocate the weight of this market sector in your portfolio.

You should buy more of what you are good at.

A positive interaction effect on the technology stocks sector would occur for instance when both of the following conditions are met:

-

- 1) your investor's portfolio weight in technology stocks was greater than the S&P500 weight in the same market sector,

-

- 2) your investor's portfolio return for technology stocks was greater than the S&P500 return for the same market sector.

In this scenario, you as an investor investor exercised good selection by buying more stocks in this market sector.

The interaction effect would also be positive if you underweighted the industries for which you underperformed because of poor selection skills.

You knew you would not be so good at making money on this sector so you didn't buy as much of it.

The Interaction Effect for the Technology stocks is calculated using the below formula:

-

- Technology stocks weight in our portfolio

-

- Technology stocks return of our portfolio

-

- Technology stocks weight in the S&P500 market

-

- Technology stocks return of the S&P500 market

Know your strengths: save time and make more money

The sum of all these effects is equal to the difference between your portfolio performance and the stock market performance.

All these effects sum to your Excess Return over the market, often referred as 'Active Return'.

Your active return explain how well you are doing over the market and why:

-

- 1) How good you are at selecting stocks in each sectors

-

- 2) How good you are at allocating your positions across sectors

-

- 3) How good you know your strengths and buy more or less of each sectors based on how well you select stocks within that sector.

When you know where your performance comes from, you can build an efficient strategy.

An investment strategy that will help you consistently beat the SP500 market.

If you had this tool before, would you have made more money by now?

Opportunities in the stock market are like sunrises; if you wait too long, you'll miss them. - Warren Buffett

Suggested Blog Stories

How does AI Stock Prediction Work? When Financial Expertise Meets Big Data

Have you wondered how the AI Model takes decisions? A 5 step guide to HelloStocker AI scientific approach...

Tesla vs Ferrari Price Prediction Analysis in Stocks To Buy AI App

1) Competition Analysis 2) Similarities and Disparities 3) Earnings per Share 4) Price to Earnings 5) Profit Margins

Bitcoin 2024 Advanced Analysis and Price Prediction

1) Bitcoin Calendar 2) Opportunities and Risks 3) Bitcoin Competitors 4) Social Trend Data 5) Technical Trading Analysis 6) Social Hype Data

Top 10 Investment Styles: Best Strategies for Your Portfolio

AI, Dividends, Value, Momentum, Quality, Crypto, ETF, Hedge Funds, Technology, Biotech, Growth, from Asset Classes to Style Factors: pick the best investment strategies for your portfolio.

Apple Stock Advanced Analysis in Stocks To Buy Now App

Quality Momentum: is Apple a buy? We analyze Apple financial performance, compare competitors, look at economics, technical trading and social hype sentiment statistics...

Should You Buy Nvidia? 5 Highlights from Price Forecast and Financial Projections

1. AI Industry Prospects 2. Financial performance 3. Competitive landscape 4. Your goals 5. Verdict: Should you buy Nvidia? Is NVDA a bubble?

How To Be A Millionaire: The Science of Compound Interest

If you save $10 a day in 10 year you will have $90,000. If you invest $10 a day in the stock market in 10 years you will have $2,000,000! Warren Buffett was hustling for pennies and at 11 years he launched his love for stock market investing when he bought his first stock...

From Budgeting to Investing: A Comprehensive Guide to Personal Finance

1) Understanding Budgeting and Its Importance 2) Tips for Effective Saving and Investment 3) Your Investment Options: Stocks, Bonds, and Mutual Funds 4) How to select the Right Investment Options 5) Retirement Planning...