Top 10 Investment Styles: Best Strategies for Your Portfolio

Understanding Asset Classes: Stocks, ETFs, Cryptocurrencies, and Hedge Funds

In the realm of investing, asset classes serve as the cornerstone for constructing diversified portfolios, each offering distinct characteristics and opportunities.

Let's explore key asset classes – stocks, Exchange-Traded Funds (ETFs), cryptocurrencies, and hedge funds – unveiling their unique features and investment potential.

1. Stocks:

- Cornerstone of Investment:

Stocks, or equities, represent ownership in companies, offering investors a stake in corporate profits and growth.

They are categorized based on market capitalization (large-cap, mid-cap, small-cap) and sector (technology, healthcare, finance, etc.).

- Market Opportunities:

Investing in stocks provides exposure to various sectors, allowing investors to capitalize on industry-specific trends.

Technology stocks signify innovation, healthcare stocks revolve around medical advancements, while financial stocks reflect economic conditions.

- Risk and Return:

Stocks are known for their potential high returns but also carry higher volatility and risk compared to other asset classes.

They can generate income through dividends and offer potential capital appreciation.

2. Exchange-Traded Funds (ETFs):

- Diversification Made Easy:

ETFs are investment funds traded on exchanges, mirroring the performance of an underlying index, commodity, sector, or asset class.

They offer diversification benefits by pooling assets from multiple investors.

- Cost-Efficient Investing:

ETFs are cost-effective due to lower expense ratios compared to mutual funds.

They provide exposure to a basket of assets, allowing investors to diversify without purchasing individual securities.

- Flexibility and Transparency:

ETFs trade like stocks throughout the day, offering flexibility in buying and selling.

They provide transparency as their holdings are disclosed regularly, aiding informed investment decisions.

3. Cryptocurrencies:

- Emergence of Digital Assets:

Cryptocurrencies, led by Bitcoin and a myriad of alternative coins (altcoins), represent a digital form of currency built on blockchain technology.

They offer decentralization and potential as a store of value.

- Volatility and Speculation:

Cryptocurrencies are highly volatile, with prices subject to rapid fluctuations.

They present opportunities for high returns but carry substantial risk due to market volatility and regulatory uncertainties.

- Blockchain Technology:

The underlying blockchain technology provides transparency, security, and decentralization.

It has applications beyond currencies, with smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs) being developed.

4. Hedge Funds:

- Sophisticated Investment Vehicles:

Hedge funds are pooled investment funds managed by professional portfolio managers, employing diverse strategies aiming to generate alpha (returns above the market).

- Strategy Diversification:

Hedge funds employ various strategies like long/short positions, arbitrage, and derivatives trading, aiming to hedge against market downturns and capitalize on market inefficiencies.

- Accredited Investor Realm:

Hedge funds cater to accredited investors, requiring substantial capital and imposing higher fees compared to traditional mutual funds.

They offer access to unique investment strategies not typically available to retail investors.

In conclusion, asset classes encompass a spectrum of investment opportunities, each with its distinct characteristics, risk profiles, and growth potential.

Understanding these asset classes empowers investors to craft diversified portfolios aligned with their risk tolerance and investment objectives, leveraging the strengths of various asset classes to optimize returns while managing risk.

Stay focused and keep tracking the Social Hype Indicator to know when to sell.

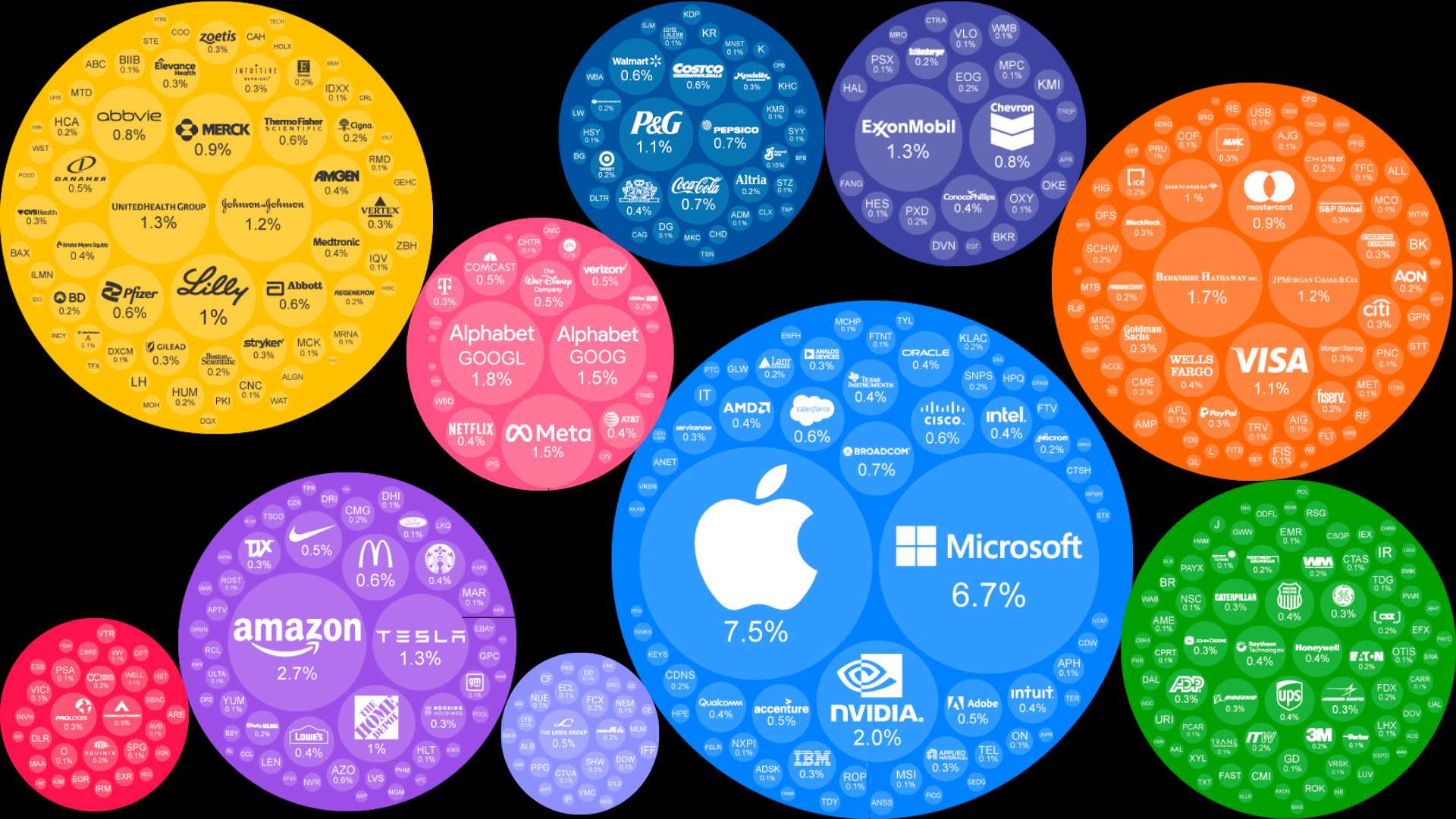

Stock market sectors

Stock market sectors play a pivotal role in categorizing companies based on their primary business activities.

Each sector encompasses distinct industries and companies, influencing investment opportunities and market dynamics. Let's explore prominent sectors and their significance in the investment landscape.

1. Tech Stocks

- Pioneering Innovation and Technology:

Technology stocks represent companies engaged in technological advancements, software development, and hardware manufacturing.

These companies drive innovation across various sectors and are known for their potential growth and disruptive technologies.

2. Healthcare Stocks

- Medical Research and Pharmaceuticals:

Healthcare stocks encompass companies involved in healthcare services, pharmaceuticals, biotechnology, and medical research. These companies focus on developing innovative treatments, drugs, and medical devices.

3. Financials Stocks

- Banking, Insurance, and Financial Services:

Financials stocks include banks, insurance companies, asset managers, and various financial service providers.

These companies offer essential financial services, facilitating economic activities and managing risks.

4. Consumer Stocks

- Catering to Consumer Demand:

Consumer stocks revolve around consumer goods, retail, and services.

These companies produce and sell products directly to consumers, covering a wide range of industries like apparel, food, and household items.

5. Communication Stocks

- Enabling Connectivity and Media Services:

Communication stocks comprise telecommunications, media, and entertainment companies.

These companies provide services that facilitate communication, content delivery, and technological advancements in connectivity.

6. Artificial Intelligence

- Tech-Driven Future Innovations:

Artificial Intelligence (AI) represents a subsector within the technology domain, focusing on companies involved in AI technologies.

These companies develop AI algorithms, machine learning applications, and automation solutions.

Each sector offers distinct investment opportunities and is influenced by unique market drivers and trends.

Tech stocks drive innovation, healthcare stocks cater to medical advancements, financials stocks reflect economic conditions, consumer stocks follow consumer behaviors, communication stocks shape connectivity, and AI stocks lead in futuristic technologies.

Investing Across Sectors

Diversifying investments across sectors is a common strategy among investors aiming to spread risks and capitalize on diverse market conditions.

It allows for exposure to various segments of the economy, reducing vulnerability to sector-specific fluctuations.

Sector Rotation Strategies

Sector rotation involves adjusting portfolio holdings based on the performance of different sectors within the market cycle.

Investors might shift allocations to sectors expected to outperform in specific economic conditions.

The Significance of Sector Analysis

Understanding sectors aids investors in strategic decision-making and portfolio construction.

Analyzing sector-specific trends, regulatory changes, and technological advancements assists in identifying potential opportunities and risks.

In conclusion, stock market sectors form the foundation of investment opportunities, offering a wide array of industries and companies to investors.

Embracing sector-based analysis and diversification strategies empowers investors to construct resilient portfolios aligned with their risk tolerance and investment objectives.

Understanding Key Investing Styles

Investing in the stock market involves various strategies, each catering to different objectives and risk appetites.

Let's explore some prominent investing styles, unveiling their unique characteristics and significance in the investment landscape.

1. Dividend Stocks

- Steady Income and Growth Potential:

Dividend stocks are renowned for their consistent dividend payments, providing investors with a reliable income stream.

These stocks often belong to well-established companies with a history of stable cash flows and shareholder-friendly policies.

2. Value Stocks

- Hunting for Undervalued Gems:

Value investing revolves around identifying stocks that trade below their intrinsic value.

Investors seek opportunities in companies with strong fundamentals but undervalued stock prices, aiming for potential capital appreciation as the market corrects its valuation.

3. Growth Stocks

- Embracing Future Potential and Expansion:

Growth stocks focus on companies exhibiting above-average growth rates in revenue and earnings.

Investors are attracted to these stocks for their potential to outpace broader market growth, often seen in innovative and disruptive industries.

4. Momentum Stocks

- Riding Market Trends and Price Momentum:

Momentum investing involves capitalizing on trends in a stock's price or market direction.

Investors seek stocks that have recently performed well, believing that the momentum will continue in the short term.

5. Quality Stocks

- Prioritizing Stability and Strong Fundamentals:

Quality stocks emphasize companies with solid fundamentals, including strong balance sheets, consistent earnings growth, and robust management.

These stocks are sought after for their stability and resilience, especially during market downturns.

6. Macro Economics

- Analyzing Broader Economic Trends:

Macro economics in investing involves understanding and analyzing broader economic factors and their impact on the financial markets.

Investors use indicators like GDP growth, inflation rates, and employment data to make informed investment decisions.

7. Technical Trading

- Leveraging Historical Data and Charts:

Technical trading relies on analyzing historical price movements and market data.

Investors use tools like charts, trends, and statistical indicators to predict future price movements and make buying or selling decisions.

Each investing style offers a distinct approach, catering to various investor preferences and objectives.

Dividend stocks are favored by income-seeking investors, while value stocks attract those seeking undervalued opportunities.

Growth stocks entice investors with their potential for rapid growth, momentum stocks target short-term trends, and quality stocks prioritize stability.

Understanding macro economics aids investors in comprehending broader economic trends, while technical trading relies on historical data for market analysis.

In conclusion, investors often blend these styles or focus on specific strategies aligned with their risk tolerance and financial goals.

Conclusion

By incorporating these styles into their investment approach, you can diversify your portfolio, optimize returns, and navigate the complexities of the financial markets effectively.

Opportunities in the stock market are like sunrises; if you wait too long, you'll miss them. - Warren Buffett

Suggested Blog Stories

How Can You Beat the S&P500 Stock Market?

We explain the methodology used at Goldman Sachs Asset Management. The stock market is like a big financial playground made up of different industries, technology, healthcare... Imagine it as a team of 500 players...

How does AI Stock Prediction Work? When Financial Expertise Meets Big Data

Have you wondered how the AI Model takes decisions? A 5 step guide to HelloStocker AI scientific approach...

Tesla vs Ferrari Price Prediction Analysis in Stocks To Buy AI App

1) Competition Analysis 2) Similarities and Disparities 3) Earnings per Share 4) Price to Earnings 5) Profit Margins

Bitcoin 2024 Advanced Analysis and Price Prediction

1) Bitcoin Calendar 2) Opportunities and Risks 3) Bitcoin Competitors 4) Social Trend Data 5) Technical Trading Analysis 6) Social Hype Data

Apple Stock Advanced Analysis in Stocks To Buy Now App

Quality Momentum: is Apple a buy? We analyze Apple financial performance, compare competitors, look at economics, technical trading and social hype sentiment statistics...

Should You Buy Nvidia? 5 Highlights from Price Forecast and Financial Projections

1. AI Industry Prospects 2. Financial performance 3. Competitive landscape 4. Your goals 5. Verdict: Should you buy Nvidia? Is NVDA a bubble?

How To Be A Millionaire: The Science of Compound Interest

If you save $10 a day in 10 year you will have $90,000. If you invest $10 a day in the stock market in 10 years you will have $2,000,000! Warren Buffett was hustling for pennies and at 11 years he launched his love for stock market investing when he bought his first stock...

From Budgeting to Investing: A Comprehensive Guide to Personal Finance

1) Understanding Budgeting and Its Importance 2) Tips for Effective Saving and Investment 3) Your Investment Options: Stocks, Bonds, and Mutual Funds 4) How to select the Right Investment Options 5) Retirement Planning...