From Budgeting to Investing: A Comprehensive Guide to Personal Finance

Introduction:

While money doesn’t grow on trees, it can grow when you save and invest wisely.

Knowing how to secure your financial well-being is one of the most important things you’ll ever need in life.

You don’t have to be a genius to do it.

You just need to know a few basics, form a plan, and be ready to stick to it.

No matter how much or little money you have, the important thing is to educate yourself about your opportunities.

No one can guarantee that you’ll make money from investments you make.

But if you get the facts about saving and investing and follow through with an intelligent plan, you should be able to gain financial security over the years and enjoy the benefits of managing your money.

1) Understanding Budgeting and Its Importance:

Budgeting serves as the cornerstone of personal finance.

It entails crafting a financial plan that outlines your income, expenses, and spending habits.

Budgeting holds immense importance as it empowers you to avoid overspending, prioritize expenses, and save for your future objectives.

To create an effective budget, initiate the process by identifying your income sources, which encompass your salary, bonuses, and any additional income streams.

Next, identify your expenses, categorizing them into fixed expenses (such as rent or mortgage payments, utilities, and car expenses) and variable expenses (including food, entertainment, and clothing).

Once you've outlined your income and expenses, embark on the budgeting journey.

Prioritize your expenditures by placing essential expenses at the top of your list, like rent or mortgage payments, utilities, and groceries. Subsequently, allocate funds to cover other expenses, such as entertainment or clothing.

Remember, the key to making your budget work lies in tracking your spending diligently.

This entails documenting every expenditure, whether through a budgeting app, spreadsheet, or a good old-fashioned notebook.

Tracking spending allows you to identify areas where overspending might occur and enables you to make necessary adjustments to your budget.

Bear in mind that budgeting is not a one-time event but an ongoing process requiring consistent monitoring and fine-tuning.

By establishing and adhering to a budget, you gain control over your finances and set the stage for a transformative financial future.

2) Tips for Effective Saving and Investment:

Saving and investing are pivotal to achieving your financial goals and securing your future.

Here are some valuable tips to help you save and invest wisely:

- 1) Start Small: Even saving a modest amount each week can accumulate over time. Begin with a small sum and gradually increase your savings as you become more comfortable with your budget.

- 2) Automate Savings: Simplify saving by automating transfers from your checking account to your savings account. This ensures consistent saving without the need for manual intervention.

- 3) Utilize Employer Retirement Plans: If your employer offers an Employee Provident Fund (EPF) or another retirement plan, take full advantage of it. These plans allow you to save for retirement while benefiting from employer contributions.

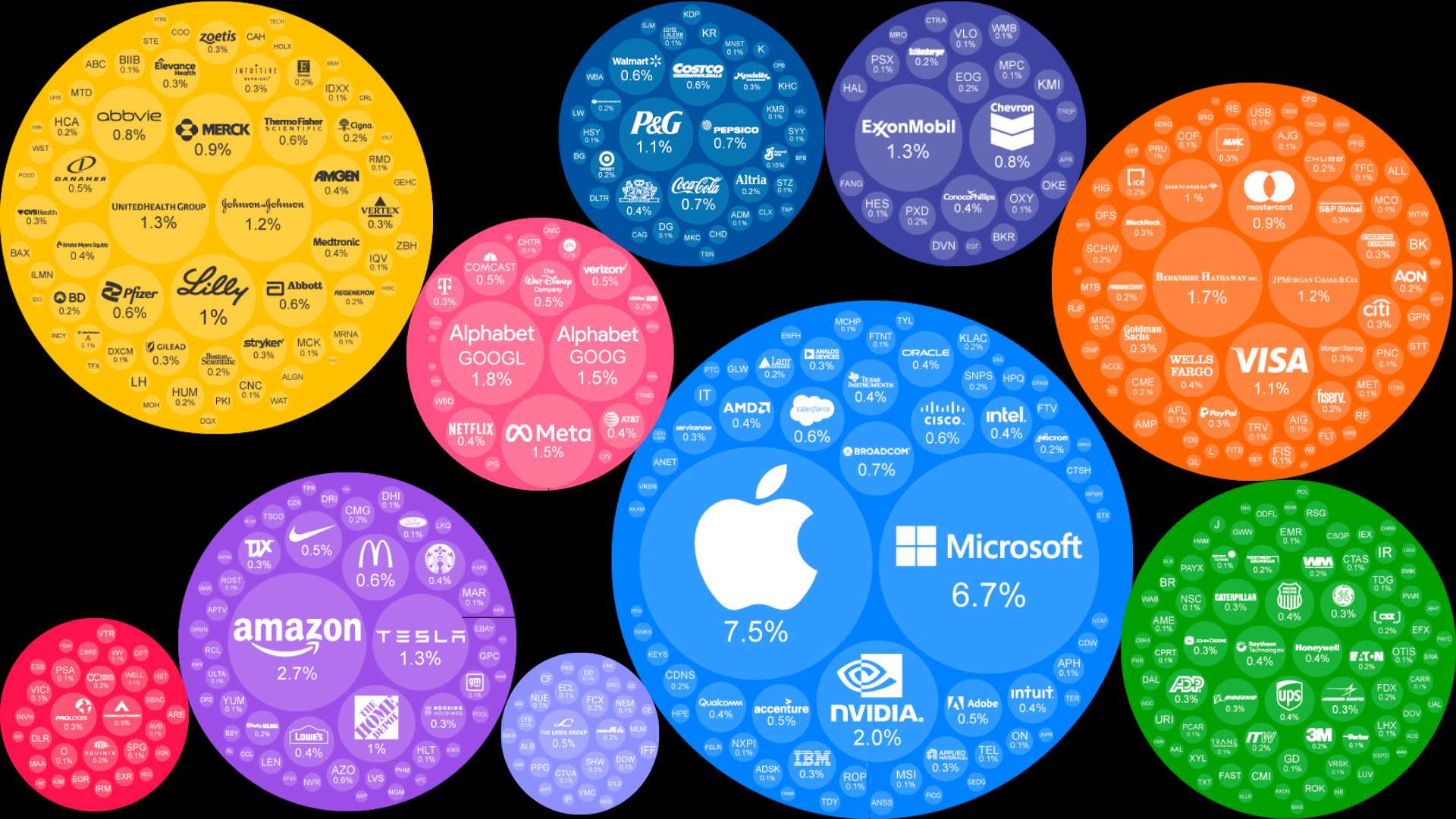

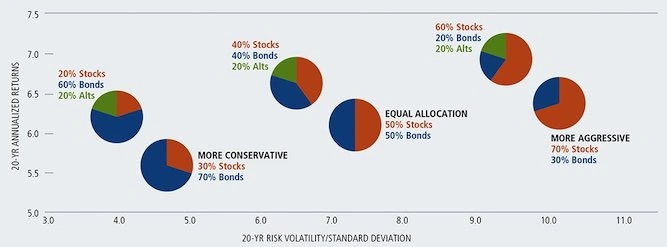

- 4) Diversify Investments: Avoid putting all your financial resources into a single investment. Diversify your portfolio by investing in a mix of stocks, bonds, and mutual funds to minimize risk.

- 5) Consider StocksToBuyNow Robo-Advisor: If you're uncertain about where to begin with investments, explore the option of using StocksToBuyNow robo-advisor. Our online investment platforms leverage algorithms to create and manage a portfolio tailored to your goals and risk tolerance.

Bear in mind that saving and investing are long-term strategies, requiring patience and discipline, especially in the face of market fluctuations.

3) Your Investment Options: Stocks, Bonds, and Mutual Funds:

Investing can be an intimidating endeavor, especially for newcomers. There exists a multitude of investment types, including stocks, bonds, and mutual funds. Here's a brief overview of each:

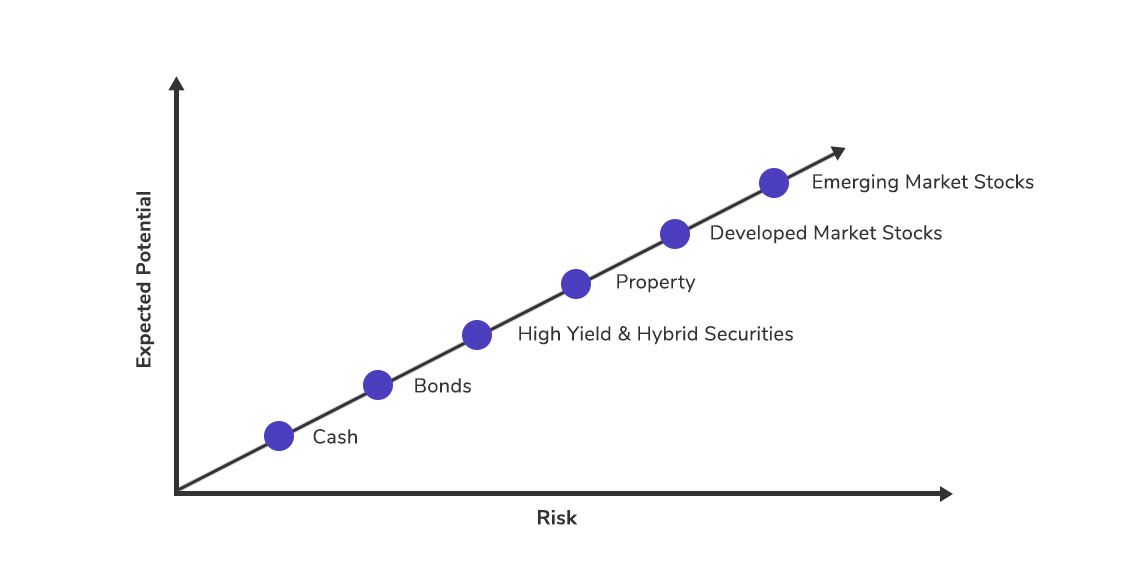

- 1) Stocks: Investing in stocks entails purchasing shares of ownership in a company. While stocks can be volatile, they offer the potential for substantial returns.

- 2) Bonds: Bond investments involve lending money to a company or government entity. Bonds are generally less volatile than stocks and offer lower returns.

- 3) Mutual Funds: Mutual funds are investment vehicles comprising stocks, bonds, and other securities managed by a professional fund manager. They provide diversification and can be an excellent option for beginners.

Each investment type carries its unique set of risks and rewards. It's crucial to conduct thorough research and gain an understanding of these risks before allocating your money.

4) How to select the Right Investment Options:

Choosing the appropriate investments can be a daunting task. Here are some guidelines to assist you in making the right selections for your investment portfolio:

- 1) Assess Your Risk Tolerance: Determine your willingness to tolerate risk. Are you comfortable with investments prone to market volatility, or do you prefer more stable options?

- 2) Consider Your Goals: What is the purpose of your investments? Are you saving for retirement, a down payment on a house, or your children's education?

- 3) Conduct Research: Dedicate time to research various investment options and gain insight into their associated risks and potential returns.

- 4) Seek Professional Guidance: If you find yourself unsure of where to commence, contemplate consulting a financial advisor. They can collaborate with you to craft a personalized investment strategy aligning with your goals and risk tolerance.

Recall that investing is a long-term pursuit. It is essential to exhibit patience and adhere to your plan, even when confronted with market fluctuations.

5) Retirement Planning: Why it is important and Where to Start:

Retirement planning constitutes an integral facet of personal finance. Initiating your retirement preparations as early as possible ensures that you accumulate sufficient savings to support yourself during your retirement years. Here are some recommendations to jumpstart your retirement planning:

- 1) Establish Retirement Goals: Ascertain the sum you need to save to maintain your desired lifestyle during retirement.

- 2) Calculate Retirement Income: Calculate the income you will receive from sources such as Social Security, pensions, and other retirement income streams.

- 3) Develop a Savings Plan: Create a retirement savings strategy outlining the monthly contributions required to attain your retirement goals.

- 4) Leverage Tax-Advantaged Retirement Accounts: Explore retirement accounts with tax advantages, such as EPF, to enhance your savings.

Keep in mind that initiating retirement savings early grants your money more time to grow, setting the stage for a comfortable retirement.

6) Common Pitfalls to Avoid in Personal Finance Management:

Managing personal finances may pose challenges, particularly for those new to the practice. Here are some common mistakes to steer clear of:

- 1) Overspending: Spending beyond your means can lead to financial debt and stress.

- 2) Lack of an Emergency Fund: An emergency fund can help cover unforeseen expenses, such as medical bills or car repairs.

- 3) Neglecting Retirement Savings: Commence retirement savings as soon as possible to ensure a secure retirement.

- 4) Failure to Diversify Investments: Investing all your resources into one venture can be risky; diversify your investments to mitigate risk.

- 5) Neglecting Professional Guidance: If you feel uncertain about managing your personal finances, consider consulting with a financial advisor for tailored assistance.

Conclusion – Seizing Control of Your Financial Destiny:

Although managing personal finances may appear daunting, it need not be overwhelming.

By grasping the fundamentals of personal finance, including budgeting, debt management, saving, and investing, you can exercise control over your financial future and reach your goals.

Always remember that personal finance is a lifelong journey, demanding patience, discipline, and consistent effort to achieve success.

Armed with the right mindset and strategies, you can reshape your financial future and embark on a path towards lifelong financial security.

Opportunities in the stock market are like sunrises; if you wait too long, you'll miss them. - Warren Buffett

Suggested Blog Stories

How Can You Beat the S&P500 Stock Market?

We explain the methodology used at Goldman Sachs Asset Management. The stock market is like a big financial playground made up of different industries, technology, healthcare... Imagine it as a team of 500 players...

How does AI Stock Prediction Work? When Financial Expertise Meets Big Data

Have you wondered how the AI Model takes decisions? A 5 step guide to HelloStocker AI scientific approach...

Tesla vs Ferrari Price Prediction Analysis in Stocks To Buy AI App

1) Competition Analysis 2) Similarities and Disparities 3) Earnings per Share 4) Price to Earnings 5) Profit Margins

Bitcoin 2024 Advanced Analysis and Price Prediction

1) Bitcoin Calendar 2) Opportunities and Risks 3) Bitcoin Competitors 4) Social Trend Data 5) Technical Trading Analysis 6) Social Hype Data

Top 10 Investment Styles: Best Strategies for Your Portfolio

AI, Dividends, Value, Momentum, Quality, Crypto, ETF, Hedge Funds, Technology, Biotech, Growth, from Asset Classes to Style Factors: pick the best investment strategies for your portfolio.

Apple Stock Advanced Analysis in Stocks To Buy Now App

Quality Momentum: is Apple a buy? We analyze Apple financial performance, compare competitors, look at economics, technical trading and social hype sentiment statistics...

Should You Buy Nvidia? 5 Highlights from Price Forecast and Financial Projections

1. AI Industry Prospects 2. Financial performance 3. Competitive landscape 4. Your goals 5. Verdict: Should you buy Nvidia? Is NVDA a bubble?

How To Be A Millionaire: The Science of Compound Interest

If you save $10 a day in 10 year you will have $90,000. If you invest $10 a day in the stock market in 10 years you will have $2,000,000! Warren Buffett was hustling for pennies and at 11 years he launched his love for stock market investing when he bought his first stock...