Bitcoin 2024 Advanced Analysis and Price Prediction

A) Bitcoin Calendar

1) Major Bitcoin Surges:

- 2013 Surge:

In April 2013, Bitcoin's price surged from around $100 to over $1,000 within a few months, marking one of its first significant price rallies.

- 2020-2021 Bull Run:

Starting in late 2020 and continuing into early 2021, Bitcoin's price surged to new all-time highs, reaching around $60,000 in April 2021.

2) Major Bitcoin Crashes:

- December 2017 - February 2018:

After reaching an all-time high near $20,000 in December 2017, Bitcoin underwent a significant correction, dropping to around $6,000 by early February 2018.

- March 2020:

In response to the COVID-19 pandemic, global markets experienced a sharp decline, and Bitcoin's price dropped from around $9,000 to nearly $4,000 within a couple of days in mid-March 2020.

- May 2021:

Following Elon Musk's announcement that Tesla would no longer accept Bitcoin as payment due to environmental concerns, Bitcoin's price plummeted from around $55,000 to below $30,000 within a few weeks.

3) Bitcoin Halving

Bitcoin halving is an event programmed into the Bitcoin protocol that occurs approximately every four years, or after every 210,000 blocks mined.

During a halving, the rewards that miners receive for validating transactions and adding blocks to the blockchain are halved.

The purpose of halving is to control the issuance rate of new Bitcoins, gradually reducing the rate at which new coins are created.

This mechanism ensures that the total supply of Bitcoin remains capped at 21 million coins, making it a deflationary asset.

The Bitcoin halving events have taken place as follows:

- November 28, 2012 (First Halving): The initial reward of 50 Bitcoins per block was reduced to 25 Bitcoins.

- July 9, 2016 (Second Halving): The block reward decreased from 25 Bitcoins to 12.5 Bitcoins.

- May 11, 2020 (Third Halving): The block reward was further reduced from 12.5 Bitcoins to 6.25 Bitcoins.

- The next Bitcoin halving is expected to occur approximately four years after the 2020 halving, in 2024.

- During this event, the block reward will be halved again, reducing the reward to 3.125 Bitcoins per block.

Halvings are significant events in the Bitcoin ecosystem as they impact the supply and potentially influence the asset's value.

The reduction in the rate of new Bitcoin creation often leads to discussions about its potential effects on the market dynamics and price.

Bitcoin price prediction is aiming for a high target at $1,000,000 (yes Million) and mid price at $200,000.

This price prediction takes into account the effect of halving, but also social trend analysis explained below, and macro economics and current inflation rates.

B) Social Trends Analysis

Based on the available Social data for Bitcoin, here are three key points and interesting statistics:

1. Increasing Social Score

The social score for BTC-USD has been steadily increasing over time.

This indicates a growing interest and engagement from the online community in Bitcoin.

It suggests that more people are discussing and sharing information about Bitcoin, which could impact its price and market sentiment.

2. Volatility and Price Fluctuations

Bitcoin has been known for its high volatility, and this is reflected in its price fluctuations

The price of BTC-USD has experienced significant ups and downs, making it an attractive investment option for traders seeking opportunities for profit

However, it also poses risks for investors due to the potential for sudden price drops.

3. Long-term Growth

Despite its volatility, Bitcoin has shown long-term growth.

Over the analyzed period, the price of BTC-USD has steadily increased, indicating a positive trend.

This growth can be attributed to factors such as increasing adoption, institutional interest, and limited supply.

However, it's important to note that past performance is not indicative of future results.

Regardless, Bitcoin price prediction is an agglomeration of multiple effects that adds up and increase the likelihood to see a 7 digit price.

Social Trend is positive, but social hype (chances of the trend being a bubble) is actually low.

Most of current flow is coming from the ETF indexation (that was released last October).

Since then, many funds and big investors started buying Bitcoin with long term views.

We are not dealing with day traders / speculators anymore.

We see serious investors putting part of their retirement in the cryptocurrency.

C) Social Hype Analysis

Based on the social hype chart for BTC-USD, here are three key points and interesting statistics:

1. Current Hype

The current social hype for BTC-USD is at a high level.

This indicates that there is a significant amount of buzz and attention surrounding Bitcoin in the social media space

It suggests that many people are discussing and sharing information about Bitcoin, which can influence its price and market sentiment.

Bitcoin trading flows are not from retail this time, now they come mostly from funds (it’s not a bubble).

This is mostly due to the ETF indexation, this rally is a slow and sure rally.

We wouldn’t be surprised if Bitcoin reaches $400,000 in 2024.

This price prediction takes into account the halving coming this year.

There could be a greater social buzz around the halving event.

Stay focused and keep tracking the Social Hype Indicator to know when to sell.

2. 52 Weeks Range Statistics

Looking at the 52 weeks range statistics, we can see that the social hype for BTC-USD has fluctuated over the past year.

It has experienced both periods of high and low social activity.

This indicates that the level of interest and discussion around Bitcoin has varied throughout the year, potentially impacting its market performance.

3. 52 Weeks Range Average

The average social hype for BTC-USD over the past 52 weeks is relatively high.

This suggests that Bitcoin has consistently attracted a significant amount of attention and discussion in the social media space over the long term.

It indicates that Bitcoin is a topic of ongoing interest and conversation among users, which can have implications for its market dynamics.

D) Bitcoin Opportunities and Risks

Bitcoin is the first and most well-known cryptocurrency, while the US Dollar is the world's primary reserve currency.

Bitcoin has gained significant attention and popularity in recent years due to its decentralized nature, limited supply, and potential as a store of value and medium of exchange.

Investing or trading in BTC-USD can offer several opportunities

1. Potential for high returns

Bitcoin has experienced significant price appreciation over the years, with some investors earning substantial profits.

The volatile nature of Bitcoin can create opportunities for traders to profit from price movements.

2. Diversification

Adding Bitcoin to an investment portfolio can provide diversification benefits.

Bitcoin and cryptocurrencies overall have a low correlation with traditional asset classes like stocks and bonds.

This can help reduce overall portfolio risk.

3. Global accessibility

Bitcoin can be bought and sold by anyone with an internet connection, making it accessible to individuals worldwide.

This global accessibility can open up investment opportunities for people in countries with limited financial infrastructure.

However, investing or trading in BTC-USD also carries certain risks.

1. Volatility

Bitcoin is known for its price volatility, with significant price swings occurring within short periods.

This volatility can lead to substantial gains but also significant losses.

Investors should be prepared for the possibility of large price fluctuations.

2. Regulatory risks

The regulatory environment for cryptocurrencies is still evolving, and governments around the world are implementing various regulations to govern their use.

Changes in regulations can impact the value and legality of Bitcoin, potentially affecting its price.

3. Security risks

Bitcoin and other cryptocurrencies are stored in digital wallets, which can be vulnerable to hacking and theft.

Investors must take precautions to secure their wallets and protect their Bitcoin holdings.

Bitcoin trading flows are not from retail this time, now they come mostly from funds (it’s not a bubble).

This is mostly due to the ETF indexation, this rally is a slow and sure rally.

We wouldn’t be surprised if Bitcoin reaches $200k in 2024.

This adds up to the halving coming this year.

There could be a greater social buzz around the halving event.

Stay focused and keep tracking the Social Hype Indicator to know when to sell.

Opportunities in the stock market are like sunrises; if you wait too long, you'll miss them. - Warren Buffett

Suggested Blog Stories

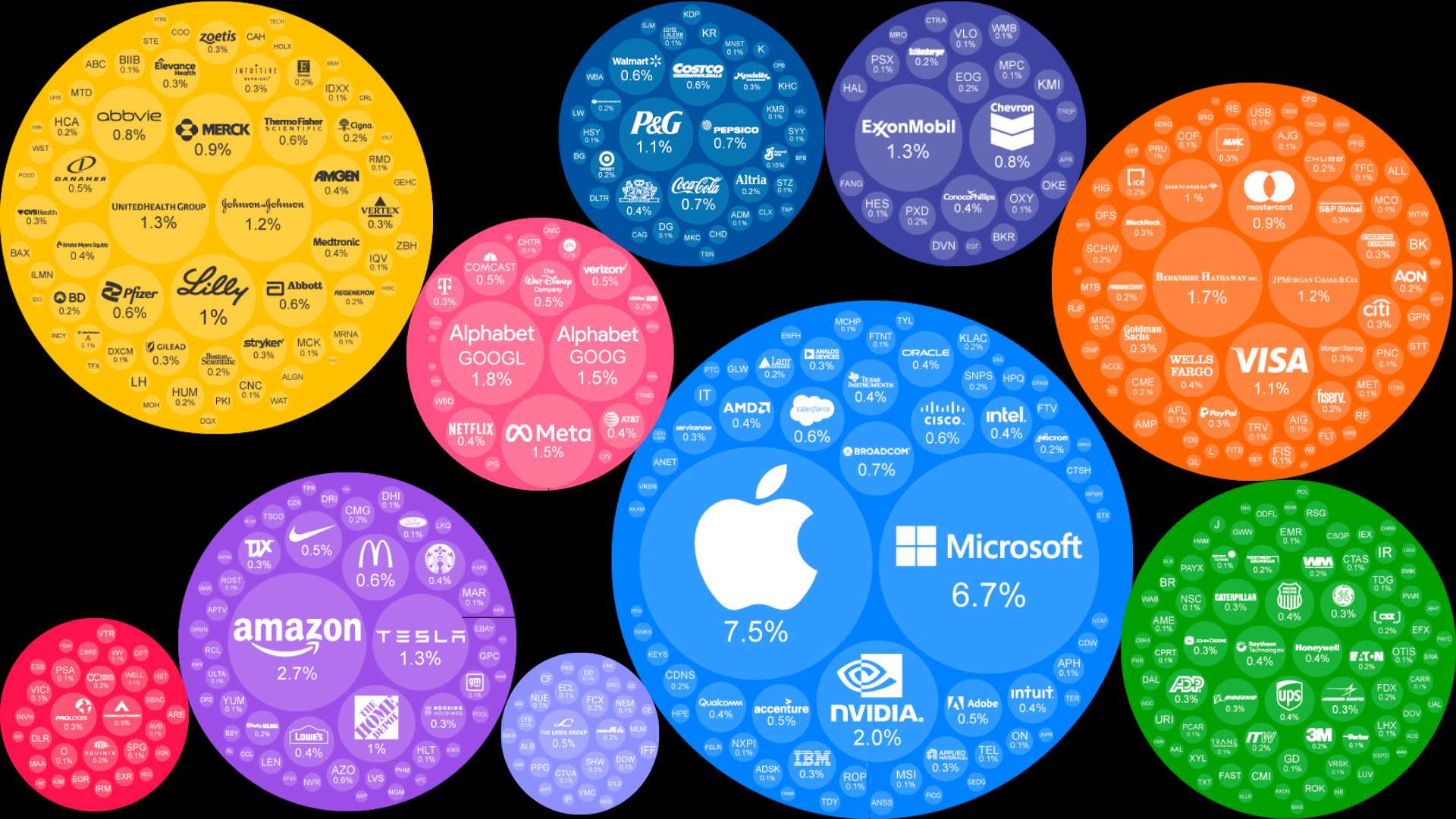

How Can You Beat the S&P500 Stock Market?

We explain the methodology used at Goldman Sachs Asset Management. The stock market is like a big financial playground made up of different industries, technology, healthcare... Imagine it as a team of 500 players...

How does AI Stock Prediction Work? When Financial Expertise Meets Big Data

Have you wondered how the AI Model takes decisions? A 5 step guide to HelloStocker AI scientific approach...

Tesla vs Ferrari Price Prediction Analysis in Stocks To Buy AI App

1) Competition Analysis 2) Similarities and Disparities 3) Earnings per Share 4) Price to Earnings 5) Profit Margins

Top 10 Investment Styles: Best Strategies for Your Portfolio

AI, Dividends, Value, Momentum, Quality, Crypto, ETF, Hedge Funds, Technology, Biotech, Growth, from Asset Classes to Style Factors: pick the best investment strategies for your portfolio.

Apple Stock Advanced Analysis in Stocks To Buy Now App

Quality Momentum: is Apple a buy? We analyze Apple financial performance, compare competitors, look at economics, technical trading and social hype sentiment statistics...

Should You Buy Nvidia? 5 Highlights from Price Forecast and Financial Projections

1. AI Industry Prospects 2. Financial performance 3. Competitive landscape 4. Your goals 5. Verdict: Should you buy Nvidia? Is NVDA a bubble?

How To Be A Millionaire: The Science of Compound Interest

If you save $10 a day in 10 year you will have $90,000. If you invest $10 a day in the stock market in 10 years you will have $2,000,000! Warren Buffett was hustling for pennies and at 11 years he launched his love for stock market investing when he bought his first stock...

From Budgeting to Investing: A Comprehensive Guide to Personal Finance

1) Understanding Budgeting and Its Importance 2) Tips for Effective Saving and Investment 3) Your Investment Options: Stocks, Bonds, and Mutual Funds 4) How to select the Right Investment Options 5) Retirement Planning...